Editing Accounts for Export

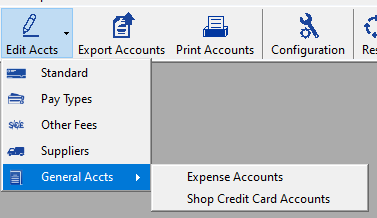

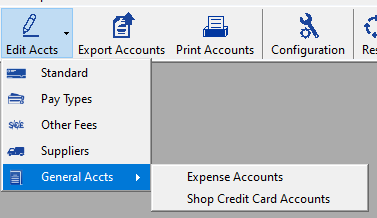

Click the arrow in the Edit Accts toolbar button. A dropdown list appears containing the account types you can edit.

Pay Types, Other Fees, and Suppliers are Configuration settings. These menu entries give you access to these Configuration settings.

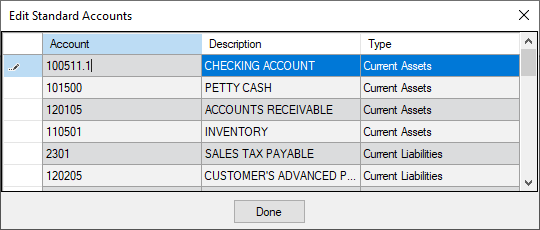

Standard

Standard Accounts are accounts that R.O. Writer must have for normal operation. You cannot delete any of these accounts or change the account types as they are all needed for proper operation.

You can edit the name of the Account by clicking inside the cell and typing. Make sure you do not use account names that conflict with other accounts used by your accounting program.

NOTE: It is strongly suggested you edit these accounts before the chart of accounts is imported into QuickBooks and not after. To verify, you can print all accounts by clicking the Print Accts toolbar button.

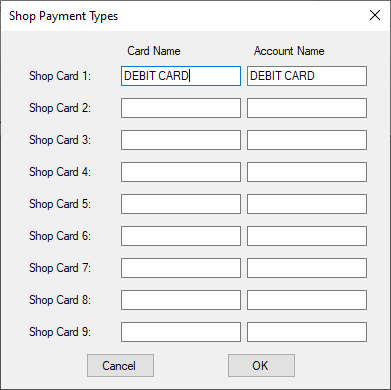

Payment Types

These are the payment methods that customers use to pay you for shop services. You need to configure payment types so that R.O. Writer knows how to record and track credit card payments as well as other payments that are not cash, paper check, or charges to customer accounts.

For full details, see Payment Types.

Other Fees

This setting allows you to configure the taxes and fees. The first five are non-taxable fees and are usually liability accounts. The next four fees are usually counted as sales accounts and taxed at your parts sales tax rate. Use these to track add-on fees that are considered sales by your state; for example: F.E.T. taxes or miscellaneous supplies.

For full details, see Other Taxes and Fees.

Suppliers

These are the suppliers you can order parts from. Some suppliers have electronic interfaces that must be configured here.

For full details, see Suppliers.

General Accts

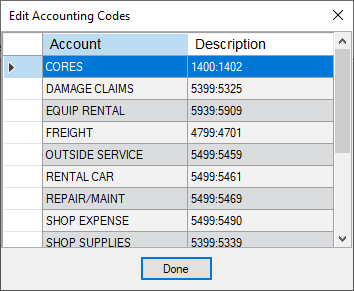

Select Expense Accounts to enter expense accounts used in Accounts Payable:

- Do not add accounts with the same name that may appear in standard accounts, other fees, or payment types.

- Do not use parts costs or Inventory.

Select Shop Credit Card Accounts to enter credit cards you hold and use to pay your suppliers in Accounts Payable. DO NOT enter the same account names you entered as the Payment Types. One suggestion might be to call the account VISA4455 where 4455 are the last 4 digits of the credit card number.

When parts are purchased that will be sold on a repair order, the Accounts Payable invoice needs to be coded to the inventory account, which already exists under standard accounts. If you do not, inventory in QuickBooks goes to a negative number because when you sell the parts, we reduce inventory in QuickBooks by the total cost of those parts and increase parts costs (cost of goods sold) account.

Inventory

There are only two ways the Inventory account is affected in QuickBooks:

- When parts are sold on repair orders

- When an AP invoice is created for parts purchased and coded to Inventory

Nothing in the Inventory module - including PO Management, Post Parts Receipts, and Adjustments - are imported into QuickBooks. Therefore, whenever you buy parts sold on repair orders, you need to create an AP invoice for those parts and use the Inventory account. If you do all your Accounts Payables in QuickBooks, follow the same rule and be sure to increase the Inventory account.

If you use the adjustments tool in the Inventory module, these adjustments are tracked on the Lost Stock Report. Use this to make general journal entries in QuickBooks to adjust the Inventory account.

QuickBooks Import Example

| Account Name | Account Type | List |

|---|---|---|

| Checking Account | Bank | Standard |

| Accounts Receivable | Other Current Asset | Standard |

| American Express | Other Current Asset | Payment Types |

| Discover | Other Current Asset | Payment Types |

| Visa/MasterCard | Other Current Asset | Payment Types |

| Coupon | Other Current Asset | Payment Types |

| Inventory | Other Current Asset | Standard |

| Petty Cash | Other Current Asset | Standard |

| Sales | Other Asset | Automatically Created |

| Accounts Payable | Other Current Liability | Standard |

| Supplier Name Accounts | Other Current Liability | Suppliers |

| Customer's Advanced Payments | Other Current Liability | Standard |

| FET Tax | Other Current Liability | Other Fees |

| Oil Recycling | Other Current Liability | Other Fees |

| Tire Tax | Other Current Liability | Other Fees |

| Sales Tax Payable | Other Current Liability | Standard |

| Visa3443 | Other Current Liability | Shop Credit Card Accounts |

| Core Charges - Non-Taxable | Income | Standard |

| Core Charges - Taxable | Income | Standard |

| Credit Card Fees | Income | Standard |

| Finance Charges | Income | Standard |

| Labor Sales - Non-Taxable | Income | Standard |

| Labor Sales - Taxable | Income | Standard |

| Parts Sales - Non-Taxable | Income | Standard |

| Parts Sales - Taxable | Income | Standard |

| Sublet Sales - Non-Taxable | Income | Standard |

| Sublet Sales - Taxable | Income | Standard |

| Parts Costs | Cost of Goods Sold | Standard |

| Bad Debts | Expense | Standard |

| Cash Drawer Adjustments | Expense | Standard |

| Credit Card Processing Fees | Expense | Standard |

| Fleet Discount | Expense | Standard |

| Freight | Expense | Expense Accounts |

| Small Tools | Expense | Expense Accounts |

| Labor Discounts - Non-Taxable | Expense | Standard |

| Labor Discounts - Taxable | Expense | Standard |

| Parts Discounts - Non-Taxable | Expense | Standard |

| Parts Discounts - Taxable | Expense | Standard |

| Sublet Discounts - Non-Taxable | Expense | Standard |

| Sublet Discounts - Taxable | Expense | Standard |

For information about what is posted to each account, see What is Imported from R.O. Writer.

For information on common errors, see Accounting Interface - Frequently Asked Questions.