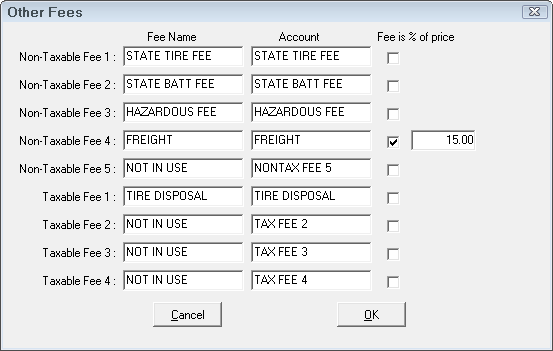

If there are certain taxes or fees associated with the sale of a part, like a scrap tax, or a tire or battery disposal fee, the descriptions and accounts for those items can be set up in this section.

The first five fees are non-taxed fees and are liability accounts.

The next four fees are usually counted as sales accounts. They are taxed at the local parts sales tax rate and can be used to track add-on fees that are considered sales by your state; for example, Federal Excise Taxes (F.E.T.) or miscellaneous supplies.

- Fee Name - This is the description to identify the fee.

- Account - This is the account number used with the Accounting Interface to pass transactions to QuickBooks. The account can be a name or an account number.

-

Fee is % of Price - Check this box to add a fee as a percent of the parts price and enter the appropriate percentage.

Accounting Interface

Other taxes and fees may also be edited in the Accounting Interface module. When used on a repair order, these may be entered as an absolute dollar amount, or calculated as a percent of the price of the associated part.

Core Charge is automatically included as one of the fees and cannot be deleted or edited.

F.E.T. Fees

The settings here are affected by the configuration of F.E.T. fees in the tire group.

- If F.E.T. fees are taxable, R.O. Writer uses Taxable Fee 4.

- If F.E.T. fees are non-taxable, R.O. Writer uses Non-Taxable Fee 5.