Aging and finance charges are an important component of your accounting practices.

Aging Account Process

When a charge is made to accounts receivable from a repair order, the date the repair order is finalized is entered as

- The transaction date,

- The first statement sent date, and

- The last statement sent date.

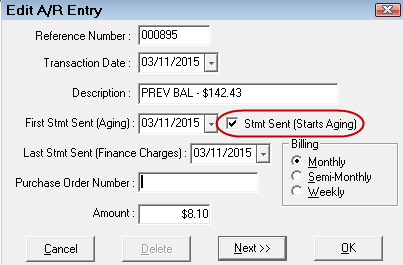

When the first statement is sent, the date is entered in the First Stmt Sent (Aging) field, and a checkmark is entered in the Stmt Sent field.

This begins the aging process for the charge. The age of the account is based on the date of the first statement or the date of the transaction, depending on the selection in AR Setup.

Finance Charges

Finance charges are not charged on finance charges but the outstanding balance of other charges.

To calculate finance charges, the number of aging days is compared to the number of days configured to begin finance charges. If the aging days exceed the number of days specified in AR Setup, then the finance charge calculations begin. The next important date is the Last Stmt Sent date in the AR Entry.

Finance Charge Calculation

The calculation for finance charge is:

(Today's date — Last statement date) / 30 = Number of months

Accounts Receivable Amount * Number of months * Finance Charge % in AR Setup = Finance charge

Customer Finance Charge Example #1

To demonstrate aging and finance charges, assume that a customer incurred a charge of $100 on June 9th.

- On June 15th, statements are run.

- On July 1st, statements are run again.

- The number of days to begin finance charges is 20 days.

- The periodic rate is 1.5%.

- Aging is based on the date of the charge.

|

Setup |

Item |

Calculations |

|

|---|---|---|---|

|

Finance Charges |

1.5% |

First Statement |

No calculations - Date entered as First and Last |

|

Begin Finance Charges |

20 days |

(June 15th) |

Statement date and Statement date box checked. |

|

Age Charges based on |

Date of charge |

N/A |

N/A |

|

N/A |

N/A |

Second Statement |

Calculate Aging: |

|

N/A |

N/A |

(July 1st) |

July 1st - June 9th = 22 days |

|

Assumptions |

N/A |

N/A |

22 - 20 days |

|

Date of Charge |

June 9th |

N/A |

Calculate Finance Charges: |

|

Date of First Statement |

June 15th |

Number of elapsed |

15 (June 15th to July 1st) |

|

Date of Second Statement |

July 1st |

Days |

N/A |

|

Amount Charged |

$100 |

Product |

1 (15/30 = 0.5 rounded to 1) |

|

N/A |

N/A |

Finance Charge Rate |

0.015 (1 X 1.5%) |

|

N/A |

N/A |

Finance Charges |

$1.50 (0.015 X $100.00) |

Customer Finance Charge Example #2

To demonstrate aging and finance charges, assume that a customer incurred a charge of $100 on June 9th.

- On June 15th, statements are run.

- On July 1st, statements are run again.

- The number of days to begin finance charges is 20 days.

- The periodic rate is 1.5%.

- Aging is based on the statement date.

| Setup | Configuration | Item | Calculations |

|---|---|---|---|

|

Finance Charges |

1.5% |

First Statement |

No calculations - Date entered as First and Last |

|

Begin Finance Charges |

20 days |

(June 15th) |

Statement date and Statement Date box checked. |

|

Age Charges based on |

Date of statement |

N/A |

N/A |

|

N/A |

N/A |

Second Statement |

Calculate Aging: |

|

N/A |

N/A |

(July 1st) |

July 1st - June 15th = 16 days |

|

Assumptions |

N/A |

N/A |

16 - 20 days |

|

Date of Charge |

June 9th |

N/A |

No Finance Charges |

|

Date of First Statement |

June 15th |

N/A |

N/A |

|

Date of Second Statement |

July 1st |

N/A |

N/A |

|

Amount Charged |

$100 |

N/A |

N/A |

NOTE: This calculation is applied to the outstanding balance of every charge, except finance charges, to calculate the total finance charges to be applied to the account. Remember that the aging report will show the age of the charges based on the selection criteria entered in Setup.