Posting Credits and Write-Off Accounts

In Accounts Receivable, you can post a credit (or credit memo), post a bad debt and resolve 0.00 totals on the Accounts Receivable Aging report and 0.00 statements printing.

Using Payment Types in Configuration

The easiest way to post a credit or write off accounts you do not receive payment from in Accounts Receivable is to set up a payment type called “Credit”, “Write Off”, “Bad Debt”, or some other name that describes its purpose.

- Do not check the Auto Deposit box.

- Add the new payment name or an account number if you use numbers under the account name as well.

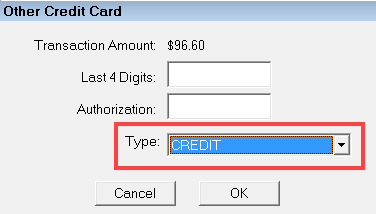

When you make a payment, click the Credit Cards or Other Credit Cards button as the payment type. On the Other Credit Card window, select in the Type dropdown list the payment type you have configured for credits and write-offs.

This will post the credit or write off to open charges the same way a payment would.

Credits on the Summary Report

The Credit payment type you created is included in the Payments Types section at the bottom of the Summary Report.

NOTE: Remember to subtract the credited amount from the total money you received that day. In QuickBooks, it will import to that account name and not be included in your regular deposit into the Checking account.

Using Edit Accounts in Accounts Receivable

Another way of posting a credit is Edit Accounts in the Accounts Receivable module.

To Add a Negative Charge as a Credit

Complete these steps:

- Select the customer.

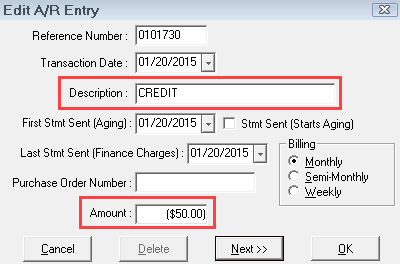

- Click the Add Charge button and add a negative charge in the Amount field.

-

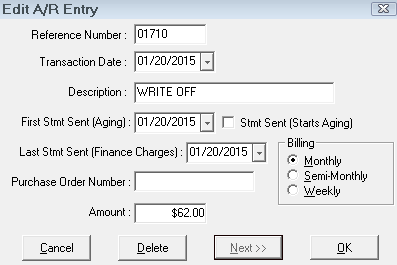

Type in a Description like “Credit” on the Edit A/R Entry window.

-

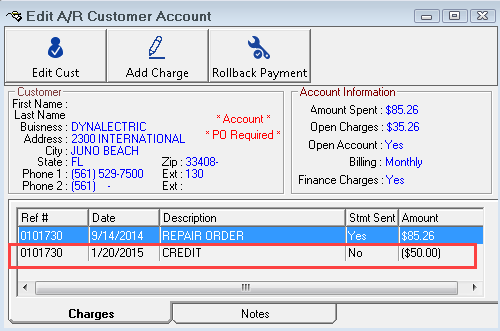

Click OK. The Edit A/R Customer Account window opens showing the negative credit.

If the customer has no other charges, you can leave the credit there until they charge again.

To Apply the Credit When a Customer Makes a Payment

When the customer makes a payment, you can apply the credit at the same time by doing the following:

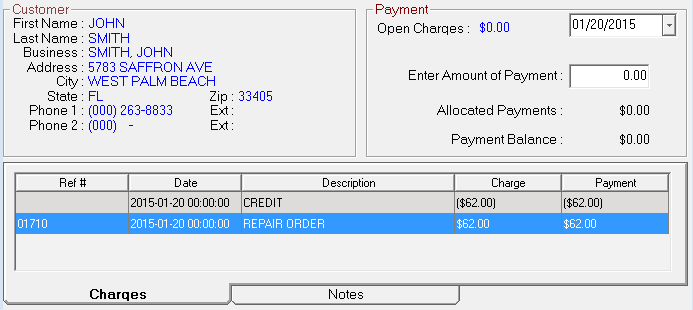

- Double-click the credit(s) in the table.

- Double-click the charge(s) in the table.

The amount of the payment plus the amount of the credit appears in the Enter Amount of Payment field.

You may need to adjust the amount of payment to ensure that the Payment Balance amount is 0.00 on the Post A/R Payments window.

To Resolve Off-Setting Charges

To resolve your offsetting charges (credit = charge which balances to 0.00) or apply the credit towards an open charge, complete these steps.

- Post a payment in Accounts Receivable.

- Leave the amount of the payment at 0.00 and double-click each of the charges that offset each other entering the amount to pay equal to the credit amount.

- When the Allocated Payments is 0.00 and the Payment Balance is 0.00, click the Post Payment button.

- The Post A/R Payments window for the customer shows the credit taken.

- Remove the charges and they will no longer show on the Aging Report as 0.00.

TIP: Always watch the Payment Balance amount. You only want to click the Post Payment button when that amount is 0.00 unless the customer did in fact overpay you and you want to leave the overpayment amount as a credit on their account.

Deleting Charges

You may decide that you just want to delete the charges but still need a way to track it.

Edit the charge in Edit Accounts and change the Description to “Write Off” or “Bad Debt” on the Edit A/R Entry window and click OK.

Edit the charge again and select Delete.

You can print a Deleted Charges report for that customer. The Description is "Write Off" or "Bad Debt".