Pre-Approval with QuickScreen

Synchrony Car Care credit contains an additional feature called "QuickScreen" that allows you to pre-approve credit applications for customers without completing a full credit application. This way, the customer can decide to apply for financing knowing that they are pre-approved.

Requirements

- Apply for Credit must be checked on the General Options window.

-

Use QuickScreen must be checked in the Credit Card App section of Electronic Payment Setup in Configuration.

Applying for Pre-Approval with QuickScreen

You can choose to apply for credit using the QuickScreen process at any time.

Complete these steps:

- Click the Apply for Credit button in the Quick Launch

.

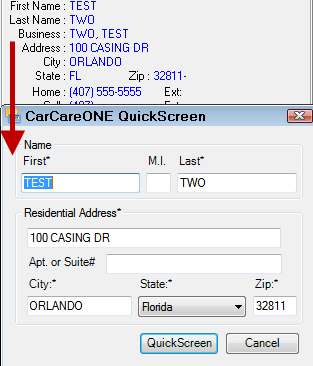

. If clicked from an open ticket, the QuickScreen window briefly flashes on the screen and runs automatically.

The customer information entered into the ticket is used for QuickScreen pre-qualification.

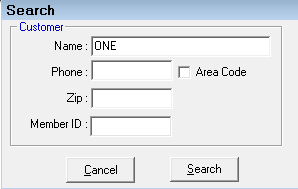

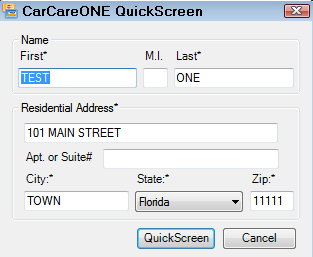

If clicked outside an open ticket, you are prompted to search for and select a customer.

After the customer is selected, the QuickScreen window briefly flashes on the screen and runs automatically.

- What happens next depends on the pre-approval results.

Applying for Pre-Approval on Payment

The QuickScreen pre-approval process runs automatically whenever you click the ePayment button for a Payment Amount that is over the QuickScreen Trigger Amount set in R.O. Writer Configuration. This includes advanced payments, finalize payments, and customer account payments.

Pre-Approval Results

The pre-approval results depend on the customer information submitted.

If the Customer is Pre-Approved

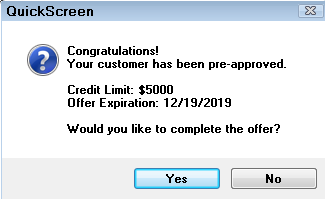

If the application is approved, the following pre-approved message appears with the credit limit and expiration date:

- Click Yes to complete the offer, which opens the full credit application.

- Click No to decline the offer, which closes the prompt and the QuickScreen windows.

If the Customer Declines the Pre-Approval

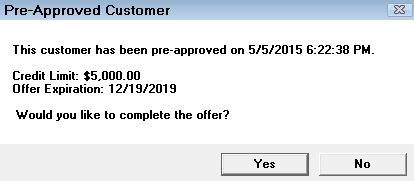

If the customer declines the pre-approved credit by clicking No on the pre-approval message, R.O. Writer stores the pre-approval.

The next time you

-

Click Apply for Credit button

for this customer.

for this customer.OR

- Click Yes when prompted to finance for this customer.

The stored pre-approval information appears displaying the date of the approval, credit limit, and offer expiration date:

At that time, the customer can accept or decline the pre-approved financing again.

If the Customer is Declined

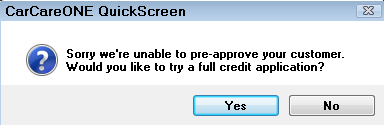

If the customer is declined, what happens depends on the Show QuickScreen Declines setting in Merchant Partners First Mile Configuration:

-

If Show QuickScreen Declines is set to Yes (which is strongly recommended), the declined message appears.

- Click Yes to open the full credit application.

- Click No to close QuickScreen.

- If Show QuickScreen Declines is set to No, nothing happens on the screen in R.O. Writer when a QuickScreen application is declined.