Processing Synchrony Car Care Credit Applications

You can offer the customer the ability to finance the repair through Synchrony.

Synchrony Credit must be configured in the First Mile Middleware software and R.O. Writer Configuration. For full details, click the following link: Configuring Synchrony Car Care Credit.

There are two methods of offering customer financing:

NOTE: If you choose to use the QuickScreen feature for pre-approval, both methods launch the QuickScreen first.

Using the Apply for Credit Button

If Apply for Credit is checked on the General Options window in R.O. Writer Configuration, the Apply for Credit button appears in the Quick Launch  .

.

If QuickScreen is enabled in R.O. Writer Configuration, the QuickScreen process runs automatically. If not, the full credit application launches.

To Apply for Credit

Complete these steps:

- Open a ticket.

- Click the Apply for Credit button in the Quick Launch

. If QuickScreen is not enabled, the full credit application launches.

. If QuickScreen is not enabled, the full credit application launches. - The Credit Terms and Conditions from Synchrony Financial appear first.

- The customer must review and accept the Credit Terms and Conditions.

-

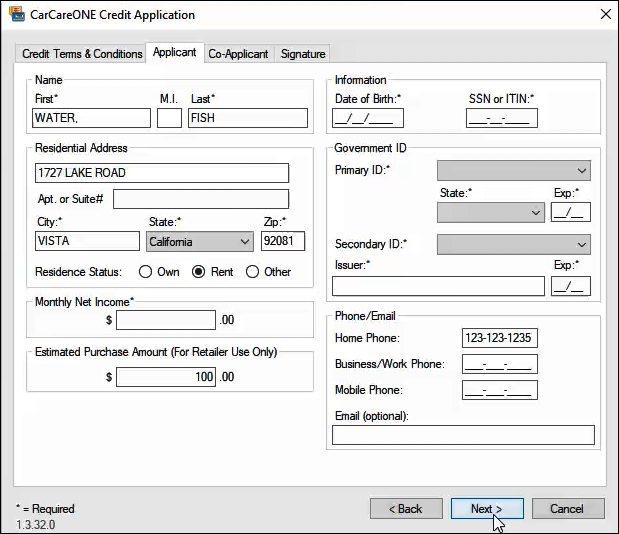

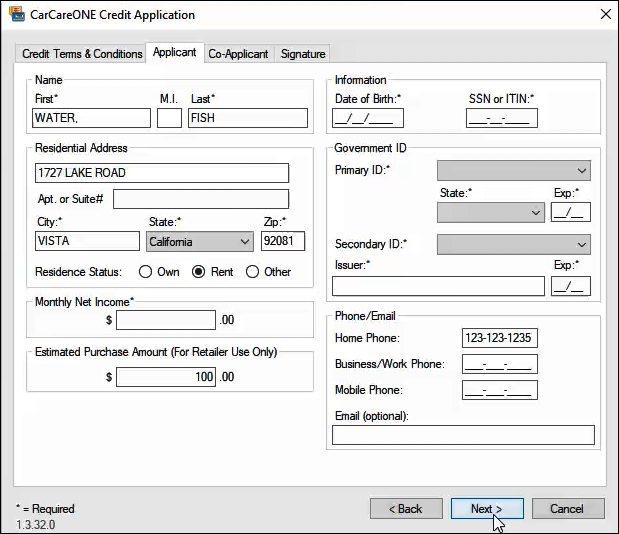

Click Next. The Applicant tab appears. The customer information from the open ticket is entered where appropriate.

- If the full credit application was opened from a QuickScreen pre-approval, only the Applicant tab appears. If not, there is a Co-Application tab where a co-applicant can be included in the application.

- Enter the required information and click Next.

- On the Signature tab, obtain the customer's signature and submit the application.

- What happens next, depends on whether the application is approved, declined, or pending.

NOTE: Credit application information is not stored locally in R.O. Writer or on the local machine.

Using the Prompt Based on Trigger Amount

If a trigger amount is set on the Credit Application tab in First Mile Middleware Configuration and QuickScreen is not enabled in R.O. Writer Configuration, a special financing prompt appears whenever the ePayment button for a Payment Amount that is over that trigger amount.

If a QuickScreen trigger amount is enabled in R.O. Writer Configuration, the QuickScreen process runs whenever the ePayment button for a Payment Amount over the trigger amount.

To Apply for Credit from a Prompt During Payment

Complete these steps:

- Open a ticket.

- Make an advanced payment or start the finalize process.

- On the payment window, review the Payment Amount to make sure that the amount is over the trigger amount.

- Click the ePayment button.

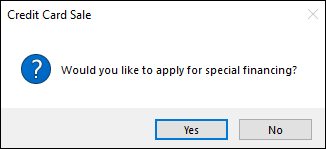

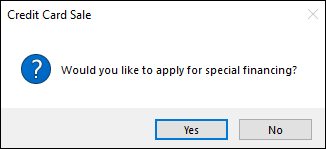

If the special financing prompt appears, click Yes to launch the full credit application.

- If the QuickScreen process runs. Click the button on the results screen that launches the full credit application.

- The Credit Terms and Conditions from Synchrony Financial appear first.

- The customer must review and accept the Credit Terms and Conditions.

-

Click Next. The Applicant tab appears. The customer information from the open ticket is entered where appropriate.

- If the full credit application was opened from a QuickScreen pre-approval, only the Applicant tab appears. If not, there is a Co-Application tab where a co-applicant can be included in the application.

- Enter the required information and click Next.

- On the Signature tab, obtain the customer's signature and submit the application.

- What happens next, depends on whether the application is approved, declined, or pending.

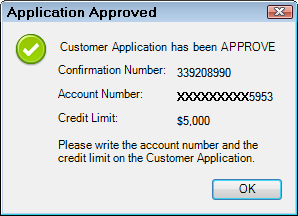

If the Customer Application is Approved

If the application is approved, the approval message returns with the confirmation number, credit card number, and credit limit:

Click OK. This window closes and the R.O. Writer creates a payment token automatically, which you can use to process payments.

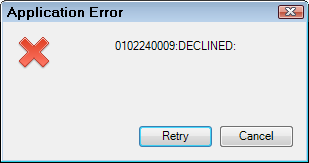

If the Customer Application is Declined

If the application is declined, the application declined message appears:

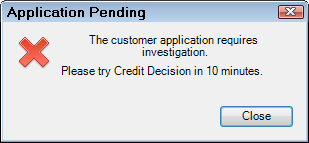

If the Customer Application is Pending

If the application is pending, that means that it has not been approved or declined. You can try again later.

The application pending message appears to tell you that a credit decision has not been made and the application is pending.

Often there is a time window when you can try again. At this time, close the credit application. R.O. Writer records that an application was sent and that it came back pending in the background.

NOTE: Credit application information is not stored locally in R.O. Writer or on the local machine.

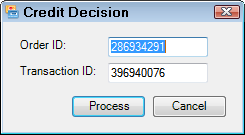

Pending Applications

The next time you click the Apply for Credit button  for this customer, a Credit Decision window opens instead of the application window. The Order ID from the previous application appears.

for this customer, a Credit Decision window opens instead of the application window. The Order ID from the previous application appears.

Click Process to send the application again. The application is accepted, declined, or remains pending.