Setting up Multiple Tax Rates

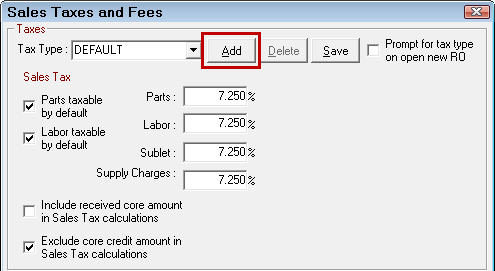

The default Tax Type for R.O. Writer is DEFAULT. You can configure multiple tax types to accommodate customers that receive different tax rates.

NOTE: The bottom options, Credit Card Fees and Supply Charges are the same for all Tax Types and do not need to be changed for each Tax Type.

To Create New Tax Type

Complete these steps:

- Click the Add button and type in a name in the Tax Type field.

- Complete the Taxes options for this tax type:

- Parts taxable by default and/or Labor taxable by default.

- Enter the tax rates for parts, labor, sublet, and supply charges.

- Select sales tax options for cores.

- Click the Save button to save. The new tax type appears in the Tax Type dropdown list.

- Select OK to exit the screen.

Prompt for Tax Type

If you want the system to prompt for tax type ever time a new estimate or repair order is opened, check the Prompt for Tax Type on Open New RO box and click the OK button to save and exit.

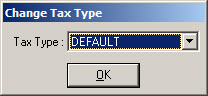

The following prompt appears every time you open an estimate or repair order. The tax type selected here overrides the tax type for the customer.

If not checked, R.O. Writer always uses the tax type selected for the customer. Customers are assigned the DEFAULT task type unless you manually change it on the Other Info tab.

To Edit or Delete Tax Types

To edit or delete tax types, select it in the Tax Type dropdown list and either

- Edit the information and click the Save button

- Click the Delete button if you wish to delete it