What is Imported from R.O. Writer

R.O. Writer accounts and what is imported from R.O. Writer.

| Account Name | Account Type |

|---|---|

|

This table describes how the accounts are imported from R.O. Writer. |

|

|

Checking Account |

Bank |

|

The name of this account can be changed to their bank name or an account number. Deposits are posted to this account. Any money received in cash, checks or payment types in which the auto deposit box is checked are posted. |

|

|

Accounts Receivable |

Other Current Asset |

|

Total AR charges and Total AR payments are posted to this account. No customer names or details are posted. If the account name in QuickBooks is not type, Other Current Asset, R.O. Writer will not be able to post to it. |

|

|

Inventory |

Other Current Asset |

|

The total cost of parts sold on tickets (both stock and non-stock) reduces this account. The offsetting transaction to this is an increase to Parts Costs account which is cost of goods sold. When parts are purchased (both stock and non-stock) and an AP invoice is posted to inventory, that total increases this account. If AP invoices are not posted to inventory when the parts are purchased, this account can go negative. |

|

|

Sales Tax Payable |

Other Current Liability |

|

Total Sales tax collected is posted to this account. If the account name in QuickBooks is not type, Other Current Liability, R.O. Writer will not be able to post to it. |

|

|

Customer's Advance Payments |

Other Current Liability |

|

When an advanced payment is posted, it gets posted as an increase to this account. When the repair order is finalized, it gets posted as a decrease to this account. Any balance to this account is advanced payments received on repair orders that have not been finalized; therefore, no sales from this repair orders have been posted yet. |

|

|

Other Current Liability |

|

|

Nothing generally gets posted to this account but AP charge invoices get posted to the supplier accounts as sub accounts underneath this account when the Accounts Payable Parent Account option is selected in Configuration in the Accounting Interface module. If the account name in QuickBooks is not type, Other Current Liability, errors will happen on import. |

|

|

Income |

|

|

Total non-taxable labor sales get posted to this account. |

|

|

Labor Sales - Taxable |

Income |

|

Total taxable labor sales get posted to this account. |

|

|

Income |

|

|

Total non-taxable sublet sales get posted to this account. |

|

|

Sublet Sales - Taxable |

Income |

|

Total taxable sublet sales get posted to this account. |

|

|

Income |

|

|

Total non-taxable parts sales get posted to this account. |

|

|

Parts Sales - Taxable |

Income |

|

Total taxable parts sales get posted to this account. |

|

|

Income |

|

|

Total non-taxable core charges get posted to this account. |

|

|

Core Charges - Taxable |

Income |

|

Total taxable core charges get posted to this account. |

|

|

Shop Supplies Sales |

Income |

|

Total Shop supplies get posted to this account. |

|

|

Income |

|

|

When a fee is set up to charge customers for using a credit card in configuration, that total gets posted here. This is not widely used and there is a question on the legality of this fee in some states. |

|

|

Income |

|

|

When finance charges are paid, they get posted as an increase to this account. Finance charges do not get posted to QuickBooks until they are paid which allows the customer to delete them if they wish without throwing anything off balance. |

|

|

Expense |

|

|

Total non-taxable labor discounts get posted to this account. |

|

|

Labor Discounts - Taxable |

Expense |

|

Total taxable labor discounts get posted to this account. |

|

|

Sublet Discounts - Non-Taxable |

Expense |

|

Total non-taxable sublet discounts get posted to this account. |

|

|

Sublet Discounts - Taxable |

Expense |

|

Total taxable sublet discounts get posted to this account. |

|

|

Parts Discounts - Non-Taxable |

Expense |

|

Total non-taxable parts discounts get posted to this account. |

|

|

Parts Discounts - Taxable |

Expense |

|

Total taxable parts discounts get posted to this account. |

|

|

Parts Costs |

Cost of Goods Sold |

|

Total Cost of Parts sold is an increase to this account. The offsetting transaction to this is a decrease to the Inventory account. |

|

|

Credit Card Processing Fees |

Expense |

|

Under payment types edit, you can enter a percentage. This is the rate the credit card company charges the shop to process the credit card. During the reconcile and the creation of the import file, it calculates a percentage of the total amount for that credit card and is posted as in increase to this account. |

|

|

Expense |

|

|

This account is currently unused. |

|

|

Expense |

|

|

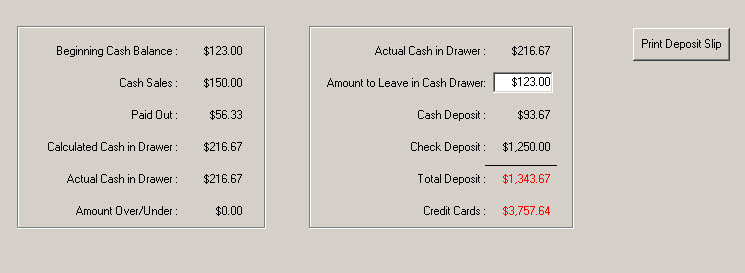

During the reconcile, the following window appears. It starts with the beginning Cash Drawer Balance, adds cash received from customers, subtracts cash paid out to vendors (AP Petty Cash invoices) and calculates how much should be in the cash drawer presently. If they count the cash and find it off, they can enter the actual amount and it calculates the amount over or under. This amount gets posted to this account and will increase or decrease the deposit amount to repopulate the cash drawer based on the Amount to leave in Petty Cash (cash drawer).

|

|

|

Fleet Discount |

Expense |

|

When a fleet account is set to receive a discount on what they owe and this gets credited to their account in Accounts Receivable, it gets posted as an increase to this account. |

|

|

MasterCard/Visa Discover American Express Any other pay types |

Other Current Asset |

|

When payment types are set up, there is a box for auto deposit. When this box is checked, the total amount received on that payment type will get posted as an increase and then a decrease to this account balancing out to 0.00 and then the total gets posted as an increase to the Checking account. This is necessary to make the whole transaction balance and provide for that box not being checked. When that box is not checked, the total for that payment type simply gets posted as an increase to that account and never gets posted to the Checking account. |

|

|

Tire Fee Battery Fee Hazardous Fee Freight |

Other Current Liability |

|

Fees added to parts are posted as an increase to this account. Taxable fees should be included on an income report in QuickBooks. Non-taxable fees are generally remitted to the state. |

|

|

O'Reilly |

Other Current Liability |

|

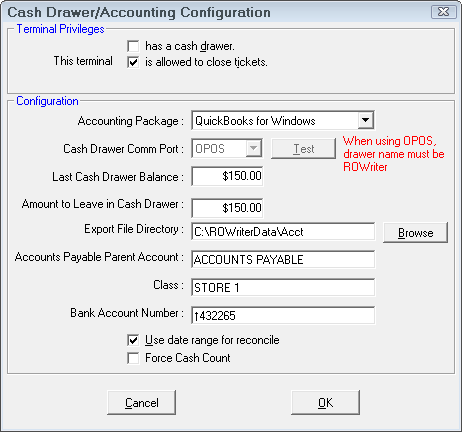

Depending on what is set up in the Accounting Interface module under Configuration> Accounts Payable Parent Account, supplier accounts will appear differently in QuickBooks.

The account name entered in this field is the account name the suppliers are sub-accounts under. If this field is left blank, they will simply be separate accounts (see below window). The advantage to having them as sub-accounts of the Accounts Payable account is in QuickBooks they can collapse all sub-accounts to see a total owed in Accounts Payable or expand all sub-accounts to see what is owed to each supplier on the chart of accounts. Each AP "charged" invoice gets posted as in increase to the appropriate supplier account. After the charged invoice(s) are paid, they get posted as a decrease to the appropriate supplier account. |

|

|

Rent Uniform Cleaning Freight |

Expense |

|

These accounts are added under General Accounts Expense Accounts. These accounts are used when posting AP invoices that are not purchased parts such as credit invoices, rent, uniform cleaning, freight, etc. The total amount of each invoice gets posted to the appropriate account as an increase. |

|

|

Visa4455 Discover1987 |

Other Current Liability |

|

These accounts are added under General Accounts Shop Credit Card Accounts. These accounts are the shops own credit cards that they pay their vendors with. When posting AP invoices or paying AP invoices by credit card, they use these pay types. It is suggested to add the last four digits of the card number to the account name so it does not match the payment types customers pay with as they are different types of accounts. The total amount posted will post as an increase to the appropriate credit card account. |

|

|

R.O. Writer Sales |

Other Asset |

|

Everything except the credit card deposits and the Accounts Payable Invoices are posted to QuickBooks as one big general journal entry where the credits equal the debits. The transactions are held in this account. If you view this account in QuickBooks, you will see a general journal entry for each day you imported with a 0.00 balance. If you click on the split to see the detail of the transaction, you may see something similar to the below window.

On the left are debits and the right are credits. Depending on the type of account as mentioned earlier in this document, debits and credits can be increases or decreases. All general journal entries must balance i.e., debits=credits. In the above example:

Notice the amount charged to Accounts Receivable was 168.59. In this case, it was one repair order which only part(s) were sold. If you add up the following credits, sales tax, shop supplies, taxable parts sales, and taxable fee 1, it all equals the total charged to Accounts Receivable. Notice the amount deposited to the Checking account was 1143.00. If you add up the Accounts Receivable payments, finance charges paid, and advance payments made on a ticket not yet closed, they all equal the total deposit (money collected). See Troubleshooting for information on common errors and other information. |

|