It is highly recommended that you always compare the daily reconcile report to the daily summary report on a daily basis to catch mistakes. Always do this comparison before clicking Yes; when you click Yes, you are saying that the report is correct and you cannot make adjustments.

You can also compare the first page of the reconcile that lists each repair order to the R.O. Sales Ledger and see which repair orders do not match.

Reopening repair orders can throw the totals off. Manual adjustments in QuickBooks can also be a factor.

If you are trying to figure out why an entire year or month is off, you might as well break it down by month, then week, then day perhaps to narrow it down and compare the numbers.

Some examples of when the totals will not match:

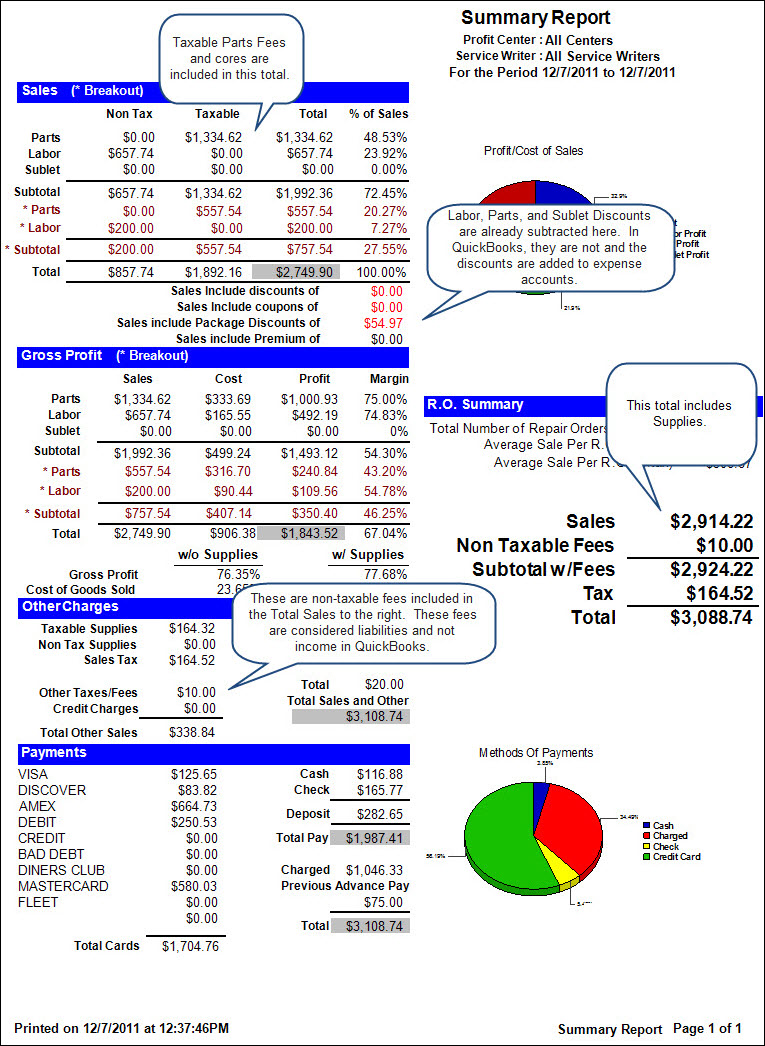

Taxable Parts Fees are included in the total parts sales and subsequently in the Total Sales figure out to the right. In QuickBooks, all parts fees are in separate accounts with the type Other Current Liability which does not show on a Profit and Loss. If you have taxable parts fees that are in fact considered income, you can edit those accounts in QuickBooks from the Chart of Accounts and change the type from Other Current Liability to Income without any problems.

From the Chart of Accounts in QuickBooks, right click on the taxable parts fee account and select Edit Account.

Select the dropdown next to Type and select the Income. This will cause the account to show as income on the Profit and Loss Report.

Non-Taxable parts fees show as Other Taxes and Fees on the Summary report and are included in the Total Sales figure out to the right even though generally they are not income but fees remitted to the state.

To identify which fees were used and the totals, you can print the Taxes/Cores Detail report for the date range in question.

Another factor is that labor, parts and sublet income accounts are the amount before discounts are subtracted. The discounts go into discount accounts for each as an expense that must be subtracted.

- LABOR DISCOUNTS - NON-TAXABLE

- LABOR DISCOUNTS - TAXABLE

- PARTS DISCOUNTS - NON-TAXABLE

- PARTS DISCOUNTS - TAXABLE

- SUBLET DISCOUNTS - NON-TAXABLE

- SUBLET DISCOUNTS - TAXABLE

The summary report shows sales with discounts already subtracted.

On the profit and loss report in QuickBooks, you will need to subtract the total discounts from the Total Income to match the Total Sales on the Summary report.

Also notice on the profit and loss report above, after changing the Tire Disposal Fee which was a taxable fee to an income type, it now shows.