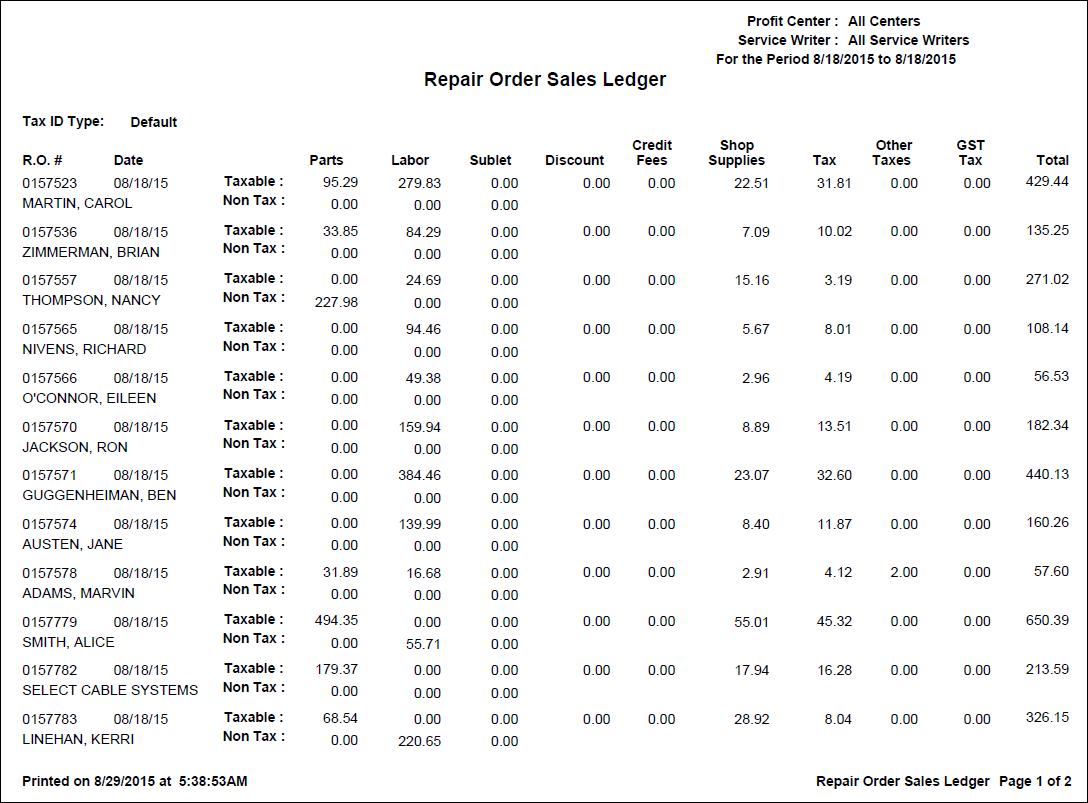

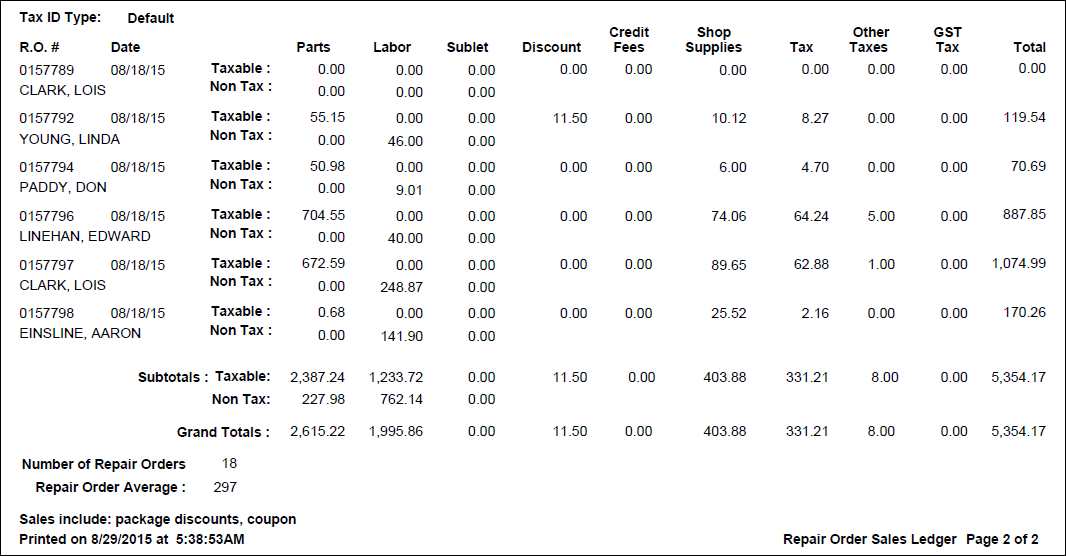

The Group by Tax ID option on the Sales Report window applies only to this report. When separate Tax IDs are set up, this report groups repair orders by Tax ID (see Multiple Tax Rates).

This report includes the following information:

- Tax ID Type - Tax ID name

- R.O. # - Repair Order Number

- Date - Date the Repair Order was finalized

- Parts Totals Taxable and Non Tax

- Labor Totals Taxable and Non Tax

- Sublet Totals Taxable and Non Tax

- Discounts are already subtracted in the totals above.

- Discounts Total

- Credit Fees - Fees charged to customers for using a credit card. This is an option in the Configuration module, Configuration > Repair Order > Taxes and Fees > Upcharge for credit card. This is a percentage of the total repair order amount that is set up.

- Shop Supplies - Total Shop Supplies charged

- Total Sales Tax

- Total Non-Taxable Parts Fees

- Total GST Tax - Only appears when International Options are turned on.

- Total - Total Repair Order amount

- Each Tax ID group will be sub totaled and the Grand total of all repair orders will show in the Grand Totals row at the bottom.

- Total Number of Repair Orders

- Average Repair Order Sales Amount rounded to the nearest dollar.

NOTE: Discounts, coupons, package discounts, package adds shown here are already included in the above totals. Coupons are only available to R.O. Writer Express users.