The Accounts Payable module enables you to

- Manage payments to those that supply goods and services to the shop.

- Print checks to vendors.

- Edit supplier information and general accounts.

- Generate reports based on the age of outstanding debts, checks that have been written, and expenses by supplier and by account code.

Understanding, planning and diligence are key factors in having the Accounts Payable system work successfully in you shop. Carefully review each section to understand the process, then prepare a plan for entering and paying invoices that works best for your shop.

Watch the video below to see an overview of this functionality.

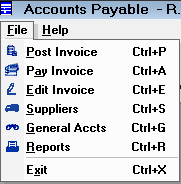

Toolbar and File Menu

The Accounts Payable toolbar and File menu provide access to the main functions of the Accounts Payable module.

![]()

The Accounts Payable File menu items match those on the toolbar.

The toolbar functions are:

| Toolbar Button | Click to... |

|---|---|

|

Enter information pertaining to an invoice received from a supplier. Choose Post Invoices by Summary - Invoices are posted in summary to a cost account. or Post Invoices by Detail - Invoices are posted in detail to a repair order, cost account, or to inventory. The invoice is marked paid if the selected payment method is petty cash or check. The invoice is marked unpaid if the selected payment method is charge. |

|

|

Pay by supplier invoices that have been charged. |

|

|

Edit open or paid invoices by supplier. |

|

|

Edit suppliers. |

|

|

Edit general cost accounts. |

|

|

Generate reports on the age of outstanding debts, check that have been written, and expenses by supplier and by account code. |

Integration With the Accounting Interface

If the Accounting Interface module is to be used in conjunction with Accounts Payable, it would be advisable to get all the general expense accounts established, and all suppliers set up with a default account code. Review the Accounting Interface to get an understanding of what is required in using the Accounting Interface, and what must be established before these modules can be used effectively.

Also be aware that any invoices paid from petty cash are included in the cash drawer reconciliation process in the Accounting Interface (see Reconcile). This provides an excellent means of balancing and tracking all petty cash expenditures.

Entering Invoices

When an invoice is received, the information about the invoice must be entered into the Accounts Payable system in order to pay and track the payment of the invoice. There are two decisions that must be made about payments.

What constitutes an invoice?

If the goal is to accurately track and account for every penny that the shop spends and where the money is spent, then a variety of things may be considered an invoice. A traditional invoice is easy to understand. If something is purchased from a department store or parts supply house, the customer generally receives an invoice, or detailed receipt from the store.

What if an employee is given money out of the cash register to purchase an item for the shop? How is this expense to be reconciled?

I recommend that some system be established for identifying all items paid from the cash drawer. This could be a simple note specifying the date, the amount of the transaction, and to whom the money was given. This could help reduce shortages in the cash drawer.

How do I post an invoice?

There are two ways to post an invoice:

- By summary, which provides an accounting for the total expenditures on the invoice to a cost account.

- By detail, which allows you to post each item of an invoice to either a cost account, inventory, or to a repair order.

This section contains the following topics: