General Accts/Edit Expense Accounts

To edit the General Accounts, click the General Accts toolbar button ![]() . There are two types of general accounts:

. There are two types of general accounts:

- Expense Accounts

- Shop Credit Card Accounts

Expense Accounts

Expense accounts represent claims of others against the company’s assets. Shop credit card accounts are used to establish electronic payment types for expenses that the shop has incurred. The expense accounts are used to track broad categories of expenses whereas the shop credit card accounts are used to track payments of expenses by electronic means.

To edit, select the appropriate account type. General Expense Accounts can also be modified in the Accounting Interface.

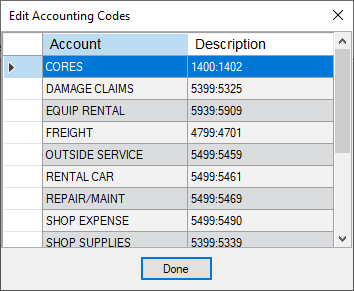

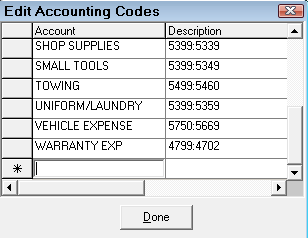

When Expense Accounts are selected, the Edit Accounting Codes window opens.

To Add an Account

Complete these steps:

- On the Edit Accounting Codes window, click inside bottom box to the right of the asterisk (*) inside the Account column.

-

A cursor appears in the Account column of that row.

- Type in the account name.

- Press the TAB key on the keyboard and type in a description in the Description column.

- Click on the asterisk (*).

- Click the Done button to save the new account and close the window.

To Delete an Account

Complete these steps:

- Select the gray box to the left of the account. An black, right-facing arrow (

) appears to indicate that the row is selected.

) appears to indicate that the row is selected. - Press the Delete key on the keyboard.

- The row is deleted.

- Click the Done button to save the change and close the window.

To Edit an Account

To edit an account, select the word to be edited by highlighting the word, then type in the change. Click the Done button to exit.

An account for Inventory does not need to be entered because that account is already in R.O. Writer under Standard accounts. Do not add a Parts Cost account because it is already included as a Standard Account.

Shop Credit Card Accounts

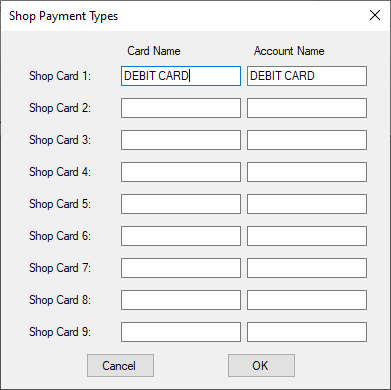

When Shop Credit Card Accounts are selected, the Shop Payment Type window appears.

These accounts are for credit cards that the facility may use to pay for purchased items. It is recommended that the credit card name and account name be something different from the account names established under Repair Order Payment Types. One way might be to add the last 4 digits of the credit card number.

These accounts represent liability accounts, and the others are asset accounts. These are exported to QuickBooks if the Accounting Interface is used. To update the payment types, type the card name and account name and click OK.