Tires are a special kind of part. Certain taxes, fees, and information apply only to tires. Therefore, R.O. Writer has created tools to help you manage tires.

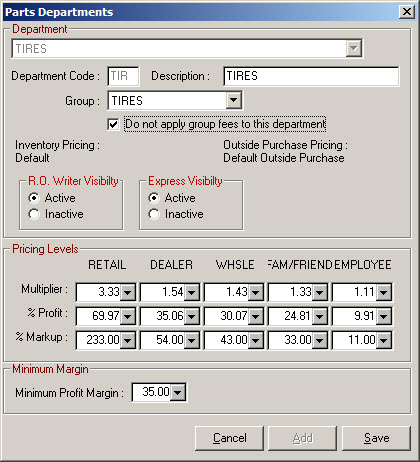

You create one Parts Department Groups specifically for tires - referred to as the "tire group". Tire parts in the tire group have:

- Specific fees associated with them that you manage through the tire group.

- The ability to enter tire information like load ratings, UTQG, and manufacturer that

- Appears whenever the part is found in searches.

- Prints on estimates, work orders, and repair orders.

- A Tire Info Button on the Edit Parts window (on estimates and repair orders). When clicked, the tire information and DOT fields appear.

Only one parts department group can be the tire group.

Only tires in the tire group are included in Tire Quote searches of your local inventory.

Creating the Tire Group

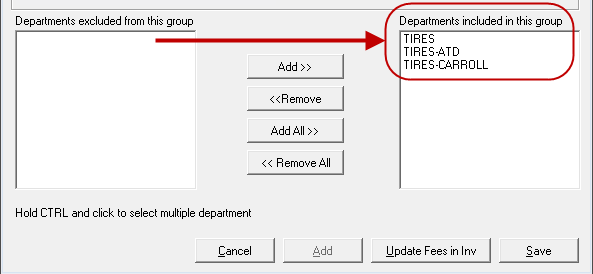

Parts in the tire group are controlled by the tire group settings and those settings apply only to tires. Therefore, the tire group should include only tires and NOT any other kind of part.

The tire group is a grouping of other parts departments that contain tires. You may want to review the parts departments that include tire parts before you add those departments to the tire group. For example, you wouldn't want to manage windshield wipers the same way you manage tires, so verify that the parts departments you add to the tire group do not include windshield wipers.

Only one parts department group can be the tire group.

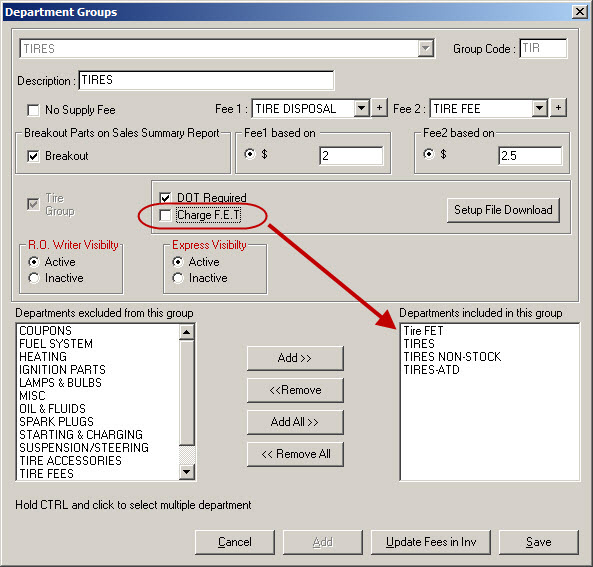

Complete these steps:

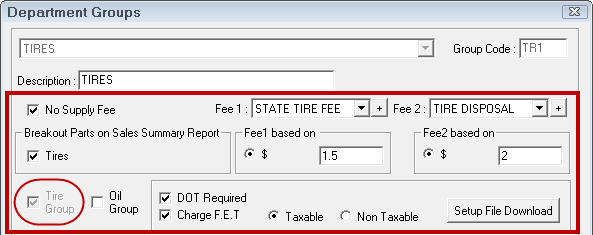

- In the Configuration module, click Configuration menu > Parts > Parts Department Groups.

- On the Departments Group window, either

- Click the Add button to create a new parts department group.

- Select an existing parts department group from the dropdown list.

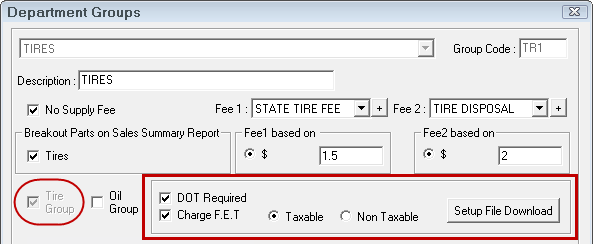

- Select the Tire Group option.

- If you do not see this option on the window, a tire group already exists. Scroll through the dropdown list to find it.

- If you do not see this option on the window, a tire group already exists. Scroll through the dropdown list to find it.

- The tire group options appear.

- Enter Fee 1 and Fee 2 according to your business needs.

- Complete the Tire Group Options.

- At the bottom of the window, add the departments that include the parts you want in the tire group. These departments should include only tires.

- Click Save to create the tire group.

Tire Group Options

This table describes the tire group options.

| Option | Description |

|---|---|

|

DOT Required |

Check this box to require that a DOT number is entered for each tire.

|

|

Charge F.E.T. |

Check this box if your local inventory includes any tires requiring an F.E.T. charge. All parts in the tire group will have an F.E.T. option enabled on the Tire Information tab of the Inventory window.

Enter a specific tax amount. That amount is added to the ticket when the part is added. Do NOT check this item if you plan to set up the F.E.T.charge as a part. |

|

Taxable |

Select to make F.E.T. fees taxable. In Other Taxes and Fees, R.O. Writer uses Taxable Fee 4. |

|

Non-Taxable |

Select to make F.E.T. tax exempt. |

Reviewing Parts Departments Before Creating the Tire Group

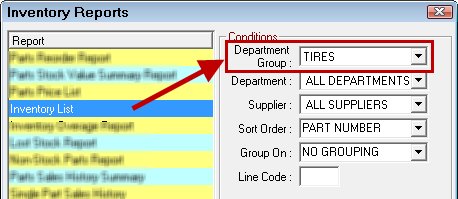

Before creating the tire group, we recommend that you review which parts are in the parts departments you want to include in the tire parts group. The fastest way to do this is to run an Inventory List report by parts department.

Complete these steps:

- Open the Inventory module.

- Click the Reports button

.

. - In the Inventory Reports list, select the Inventory List.

- In the Department dropdown list, select the parts department whose parts you want to review.

- Select the other options as applicable.

- Click Print.

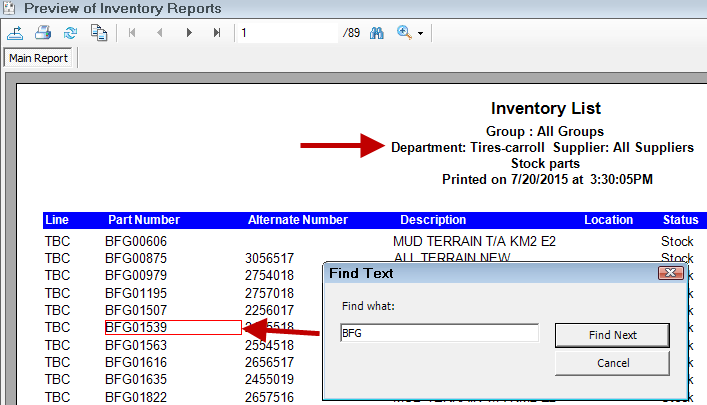

- On the Printing Options window, select Screen and click OK. The print preview window opens displaying the parts in the selected parts department.

- Click CTRL + F and search for parts that you may want to check on.

You can also print the list and review it thoroughly.

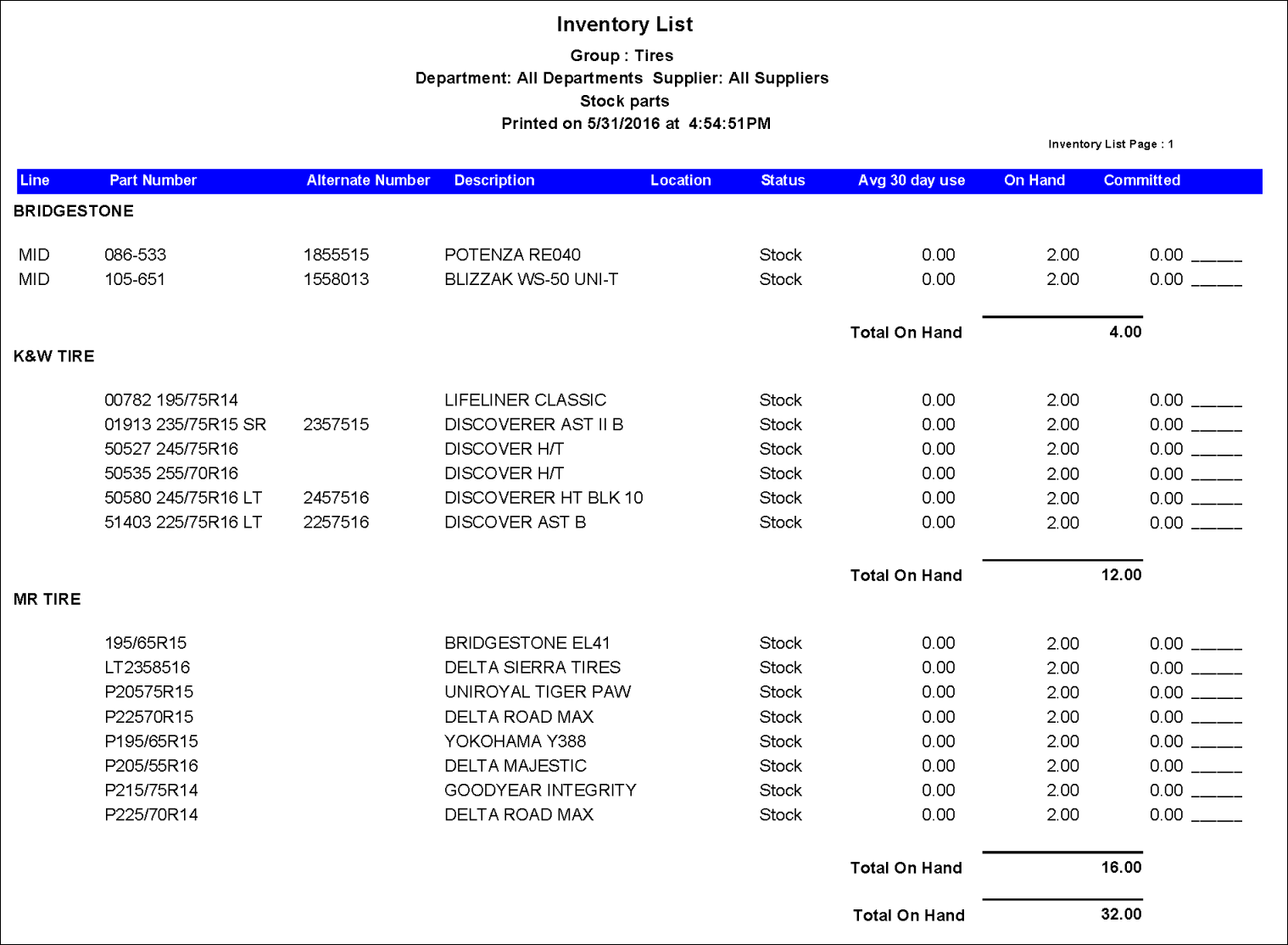

Reviewing Parts in an Existing Tire Group

If the tire group already exists, you can run an Inventory List report by the tire parts department group.

When the report is run,

- The heading indicates that it's for the tire group.

- If you select a Group - such as Supplier - a subtotal appears for each supplier.

Tires Group Tires in Inventory

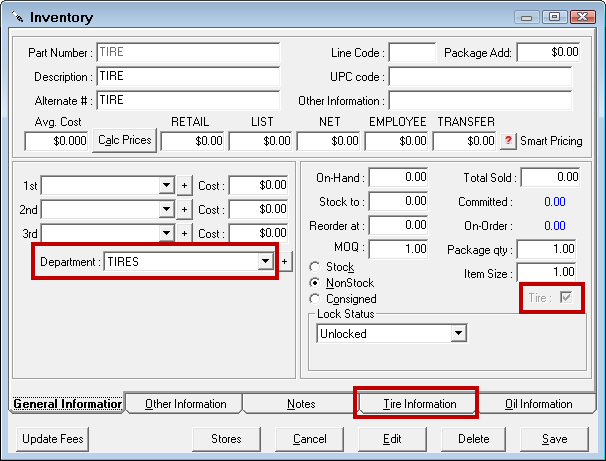

Tires in the tire group

- Are in a Department that is in the tire group.

- Have a Tire option that is selected and disabled on the General Information tab.

- Have an enabled Adding Tire Information.

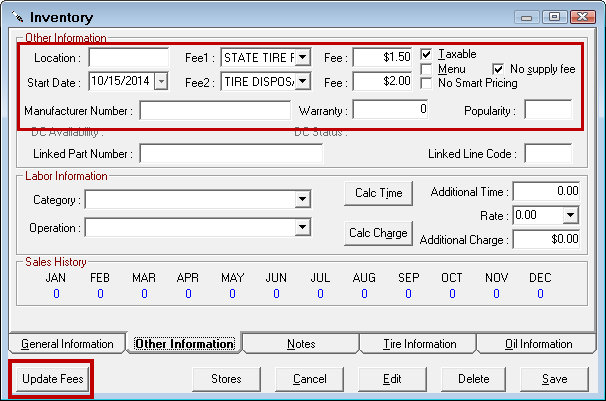

Managing Fees through the Tire Group

Every Inventory record has an Other Information Section of the Other Information tab where you set fees for parts. The fees entered here apply only to the individual part.

For tires in the tire group, it is best to manage these fees with the tire group settings.

To Change Fees for All Tires in the Tire Group

Complete these steps:

- Open the tire group in Configuration.

- On the Department Groups window, enter the new fee information, and click

at the bottom of the window.

at the bottom of the window. - All tires in the tire group are updated with the new fees.

NOTE: F.E.T. fees are not managed this way. If Charge F.E.T. is selected in the tire group, you enter the specific charge on each tire individually.

Deleting the Tire Group

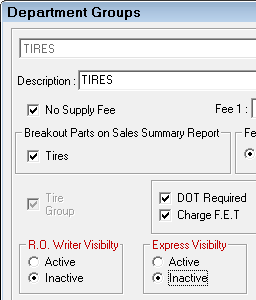

You cannot delete the tire group, but you are able to make it inactive in R. O. Writer and Express by selecting the Inactive option on the Parts Department Group window.

Inactive tire groups:

- Don’t appear in dropdown lists in other parts of R.O. Writer, including the Department Group dropdown list in Inventory Reports.

- Do appear in the dropdown list on this window so they can be edited or reactivated.

After the tire group has been inactivated, the Tire Group option is active for new parts department groups.

At the group level, the only difference between an active and inactive tire group is that you

- Can't add new parts departments to an inactive tire group.

- Can't run a report for the group in Inventory.

Inactive Tire Group Parts

Inactivating the tire group has no impact on the parts in the inactive tire group.

- The Tire Information tab is still active in Inventory.

- The Tire Info button still appears on the Edit Parts window.

- Tire information still appears in all the same places.

F.E.T. as a Part

Instead of using the Charge FET option in the tire group, you can create F.E.T. as a part in Inventory and then link it to the tire part if you need to

- Track F.E.T. separately in Accounts Payable and on the Parts Stock Value Report.

- Calculate a percentage tire disposal on the F.E.T. as well.

When that tire part is added to an estimate or repair order, the F.E.T. tax is added with it automatically.

NOTE: If you choose this method, do NOT check the Charge F.E.T. option in the tire group because you are not using it and you don't want to risk taxing a tax.

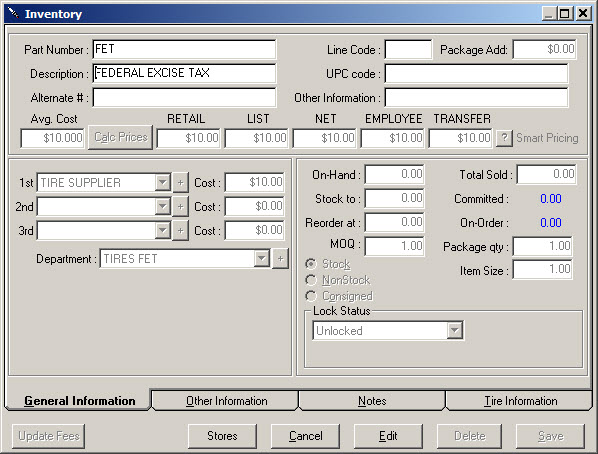

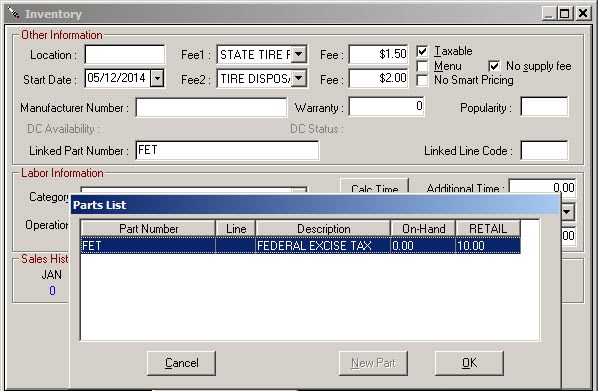

In Inventory, click the Inventory button and select Inventory Entry.

Enter "FET" as a part number. (You can also set up and FET part for each FET amount such as FET10 ($10.00), FET15 ($15.00), or FET20 ($20.00).)

Average cost is updated as F.E.T. fees are received and sold just as the parts do now. It shows a value of all tires on-hand that include an F.E.T.

The retail price should always be adjusted to match the average cost in order to ensure the customer is charged correctly.

The part should be stock so it can be tracked on the Parts Stock Value Report and the on-hand can be increased when added to inventory and depleted when the F.E.T. is relieved.

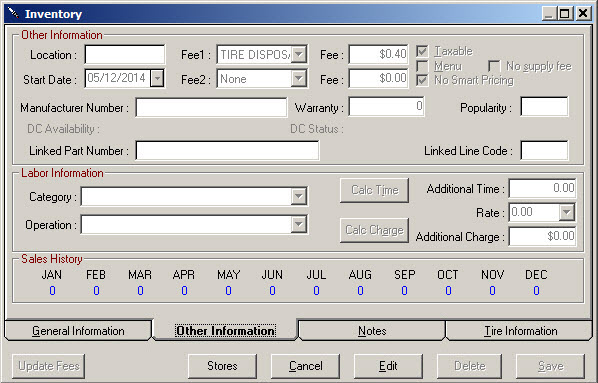

You need to select the No Smart Pricing checkbox.

The Tire disposal fee should be set up as an amount or percentage that can be added to the F.E.T. itself.

You may want to also set up a separate parts department that can be added to the tire group for reporting purposes, but the parts department should not update the fees from the tire group.

Edit each tire in inventory that requires an F.E.T., click the Other Information tab at the bottom and type all or a portion of the part number for the F.E.T. and press enter to search inventory. In the parts list, double-click on the part number or select the part number and click OK.

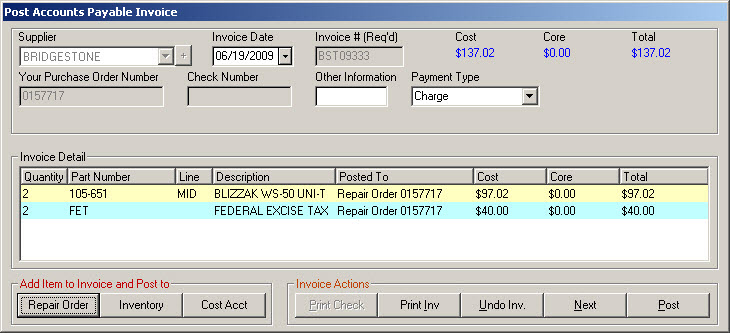

When a tire is purchased that includes an F.E.T. fee, both the tire and the F.E.T. should be added to the AP invoice.

When the tire is sold, the F.E.T. part is automatically added when the tire is posted to the ticket.

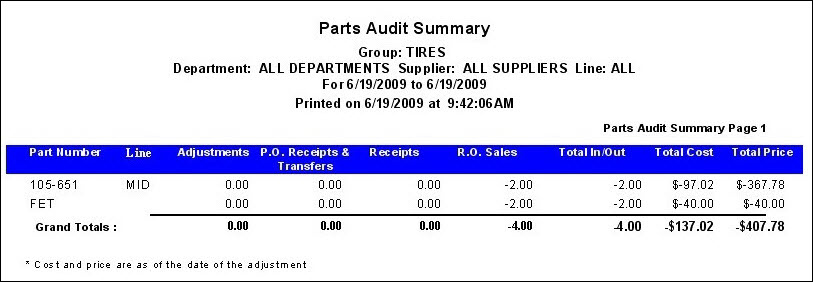

A Part Audit Trail Report can be printed to screen by selecting the tire group. The report shows the number of F.E.T. parts received and sold.

F.E.T. is also included on the Parts Stock Value Report and the Parts Stock Value Detail Report. The Stock Value reports can be printed for the tire group only and the F.E.T. fee is part of the tire value.