The Itemized Sales Report shows sales for each part.

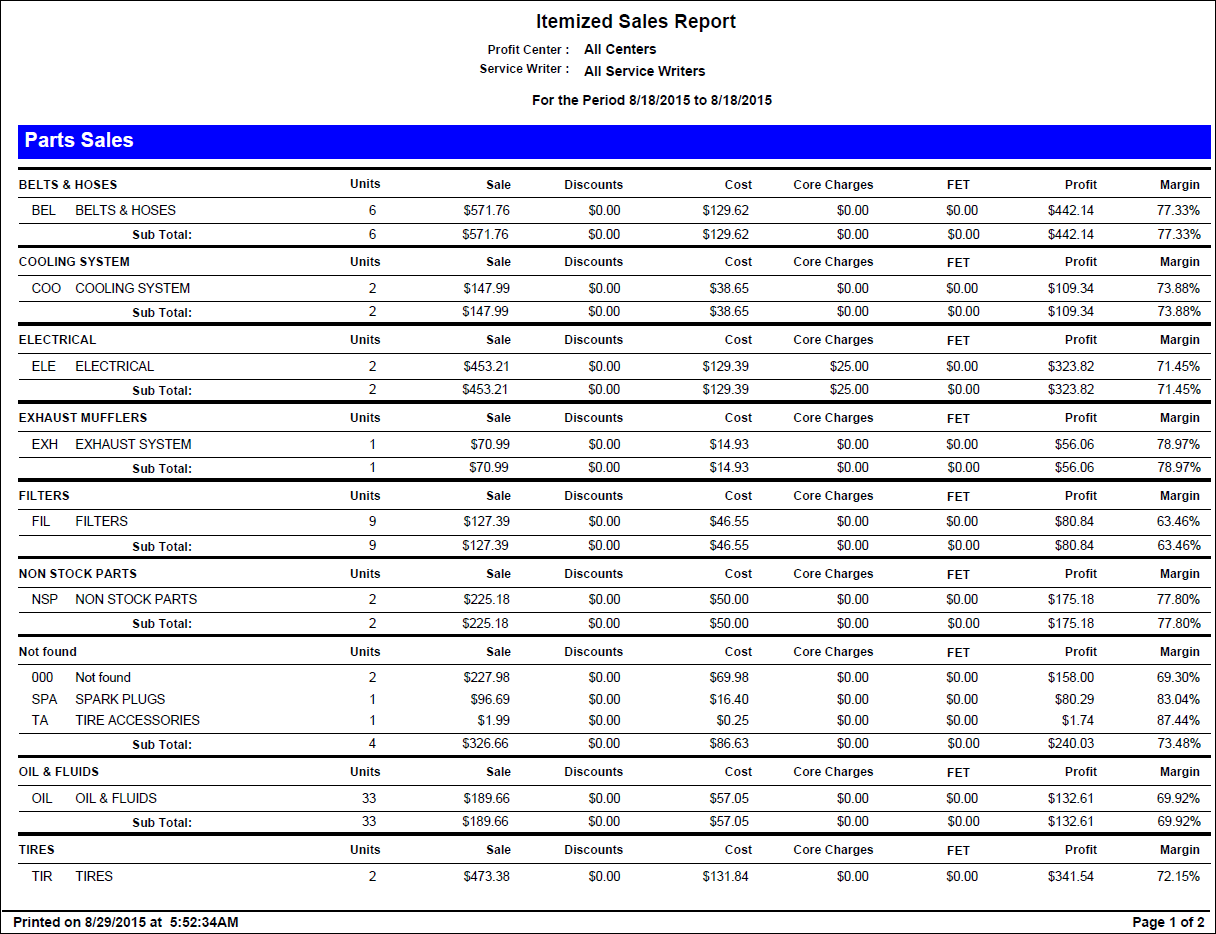

First Page of the Itemized Sales Report

Parts are organized and listed by parts department. Each parts department appears in its own section.

Itemized Sales Report Columns

| Column | Definition |

|---|---|

| Units | Total quantity |

| Sale | Total parts sales |

| Discounts | Total amount of discounts |

| Cost | Total parts cost |

| Core Charges | Total amount of core charges |

| FET | Total tire FET fees |

| Profit | Total profit amount |

| Margin | Profit percentage |

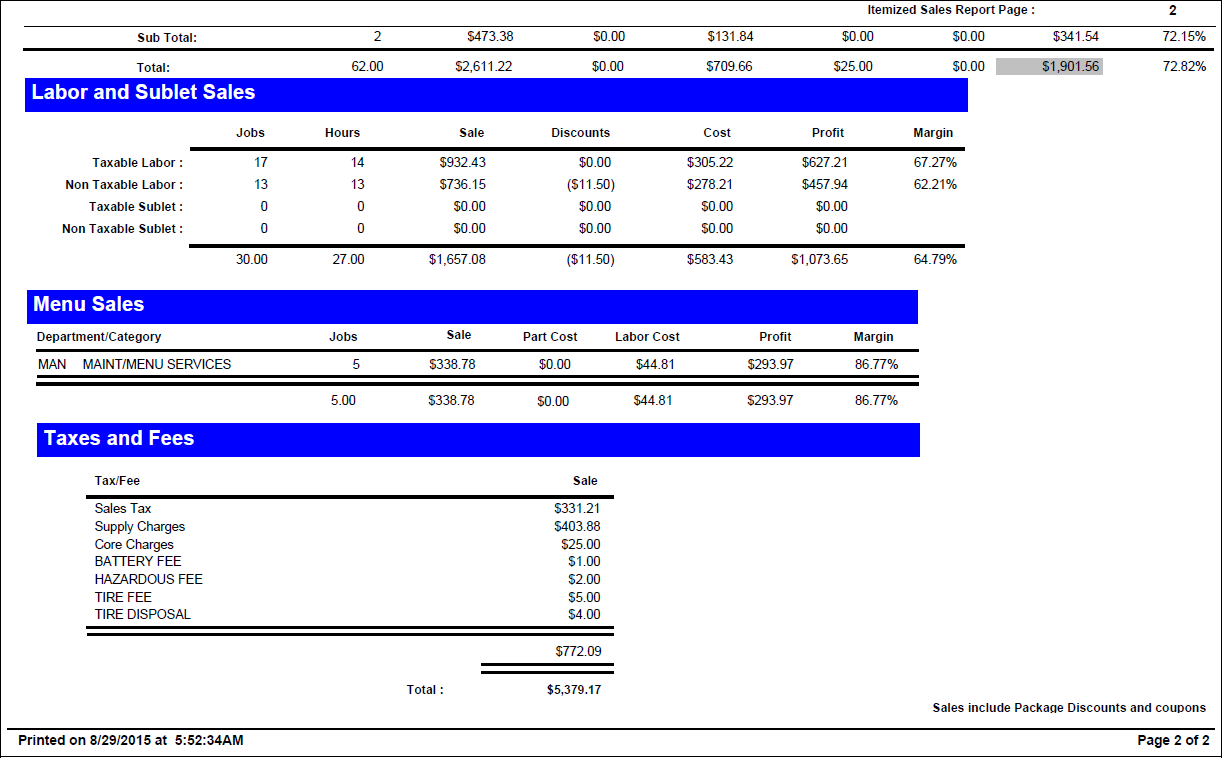

Totals Page of the Itemized Sales Report

The totals page is usually the last page of the Itemized Sales Report. The totals include several totals.

Labor and Sublet Sales Totals

This section displays the totals for each Taxable and Non Tax Labor, Taxable and Non Tax Sublet.

| Column | Definition |

|---|---|

| Jobs | Number of labor operations |

| Hours | Total hours |

| Sale | Total labor charges |

| Discounts | Total amount of discounts |

| Cost | Total labor cost hours times the technician’s rate |

| Profit | Total profit |

| Margin | Profit percentage |

Menu Sales

Totals for menu sales include labor operations and parts that have the Menu option checked. Totals are split by Labor Category for labor totals and parts department for parts totals.

| Column | Definition |

|---|---|

| Jobs | Number of labor operations |

| Sale | Total sales amount |

| Part Cost | Total part cost |

| Labor Cost | Total labor cost |

| Profit | Total profit amount |

| Margin | Profit percentage |

Labor Totals in the "Not Found" category are the labor operations not assigned to any labor category or whose labor categories were deleted.

Parts Totals in the "Not Found" category are the parts not assigned to any parts department or whose parts departments were deleted.

Taxes and Fees

The discounts, coupons, package discounts, and package adds in this section are also included in the above totals.

| Column | Definition |

|---|---|

| Sales Tax | Total sales taxes |

| Supply Charges | Total supply charges |

| Core Charges | Total core charges |

| Taxable and Non Taxable Parts Fees | Itemized on separate lines |

| Credit Card Fee |

The total fees your shop charged customers for using a credit card. This is setting in Configuration that allows you to charge a percentage of the repair order as a fee for paying with a credit card. (Configuration menu > Repair Order > Taxes and Fees > Credit Card Fees > Upcharge for credit card) |