This report provides a snapshot of sales and cash flow activity for your shop. There are two pages and sections on each page feature specific measurements of shop performance.

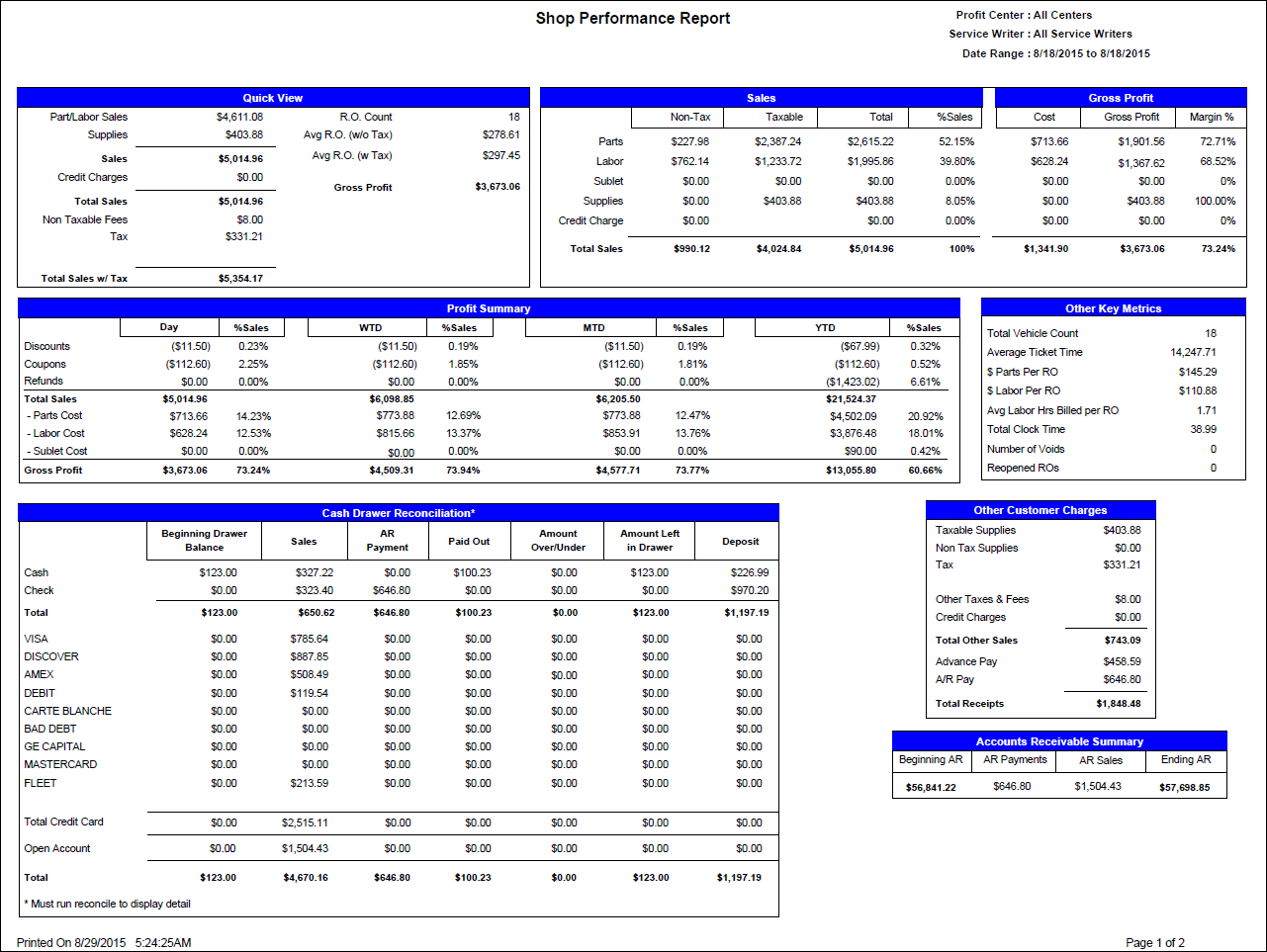

Quick View Section

| Row | Definition |

|---|---|

|

Parts/Labor Sales |

Total parts, labor, and sublet. Sales include discounts, coupons (Coupons are only available for R.O. Writer Express users.), and package discounts. |

|

Supplies |

Total supply charges |

|

Credit Charges |

Fees charged to customers for using a credit card. This is a percentage of the total repair order amount set up in Configuration module > Configuration menu > Repair Order > Taxes and Fees > Upcharge for credit card. |

|

Total non-taxable parts fees not including core charges. |

|

|

Tax |

Total Sales Taxes |

|

R.O. Count |

Total number of repair orders finalized |

|

Avg R.O. (w/o Tax) |

Average sales per repair order not including sales taxes. |

|

Avg R.O. (w Tax) |

Average sales per repair order including sales taxes. |

|

Total Sales w/ Tax |

The grand total of all items above. |

Sales and Gross Profit

This section displays total non-taxable sales, taxable sales, total sales, % of sales, cost, gross profit, and profit margin for parts, labor, sublet, supplies, and credit charges.

Profit Summary

This section displays totals and % of sales by day, week to date (Sunday to Saturday), month to date (First of the month to date), and year to date (January 1 to date) for Discounts, Coupons, Refunds, Parts Cost, Labor Cost, Sublet Cost, and Gross Profit.

Other Key Metrics

| Row | Definition |

|---|---|

|

Total Vehicle Count |

Total number of vehicles |

|

Average Ticket Time |

The arrival time on the Service Requests tab and the time the ticket is closed. |

|

$ Parts Per RO |

Average parts sales per repair order. |

|

$ Labor Per RO |

Average labor sales per repair order. |

|

Avg Labor Hrs Billed per RO |

Average number of hours billed per repair order. |

|

Total Clock Time |

Total hours employees were clocked in using the Employee Time Clock. |

|

Number of Voids |

Number of repair orders voided |

|

Reopened ROs |

Number of repair orders reopened from history. |

Cash Drawer Reconciliation*

*Reconcile must be run from the Accounting Interface module before running this report.

This section includes:

- Total amount brought in that day in sales for each payment type and charge to Accounts Receivable.

- Total amount brought in that day via Accounts Receivable payments for each payment type.

- Total amount of cash paid out via Accounts Payable that day.

- Total amount the cash drawer was over or under.

- Total amount left in the cash drawer.

- Total amount of the bank deposit.

Other Customer Charges

| Row | Definition |

|---|---|

|

Taxable Supplies |

Amount of taxable supply charges. |

|

Non Tax Supplies |

Amount of non-taxable supply charges (Non-taxable supplies are supplies calculated on repair orders that charged no sales taxes such as in the case the customer was tax exempt). |

|

Tax |

Amount of sales taxes. |

|

Non-taxable parts fees not including core charges. |

|

|

Credit Charges |

Fees charged to customers for using a credit card. This is a percentage of the total repair order amount set up in Configuration module > Configuration menu > Repair Order > Taxes and Fees > Upcharge for credit card. |

|

Taxable Supplies + Non-Taxable Supplies + Other Taxes and Fees + Credit Charges |

|

|

Advance Pay |

Total amount of advance payments. |

|

A/R Pay |

Total amount of payments posted in Accounts Receivable. |

|

Total Receipts |

Total Advance Payments + Total Accounts Receivable Payments |

Accounts Receivable Summary

This section displays total amounts in Accounts Receivable.

| Column | Definition |

|---|---|

|

Beginning AR |

Total beginning amount owed. |

|

AR Payments |

Total amount of payments posted. |

|

AR Sales |

Total amount charge to customers. |

|

Ending AR |

Total ending amount owed your shop. |

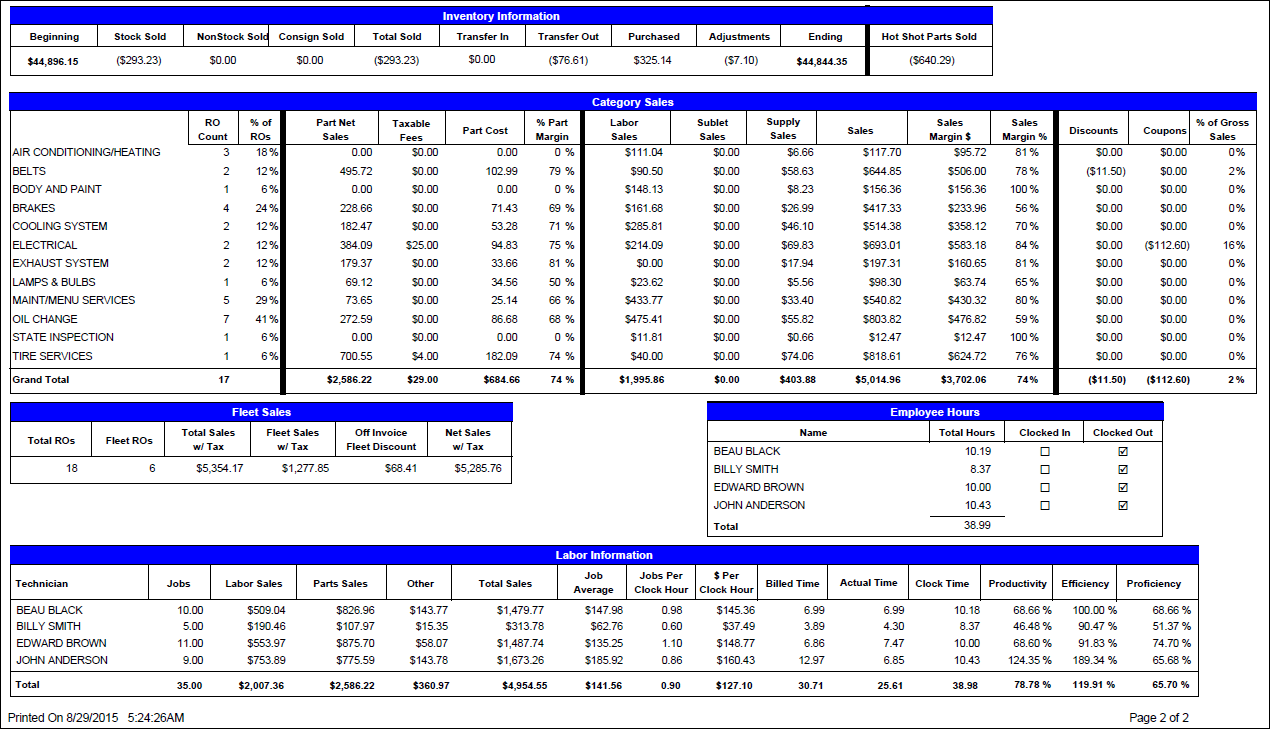

The second page contains the following:

Inventory Information

| Column | Definition |

|---|---|

|

Beginning Inventory Value |

|

|

Stock Sold |

Total stock parts sold. |

|

Non-Stock Sold |

Total non-stock parts sold |

|

Consign Sold |

Total Consigned parts sold |

|

Total Sold |

Total of all parts sold |

|

Transfer In |

Total cost of parts transferred in from another store (see Transfers). |

|

Transfer Out |

Total cost of parts transferred to another store (see Transfers). |

|

Purchased |

Total cost of parts received into Inventory using Post Receipts or PO Management. |

|

Adjustment |

Total cost of parts adjusted in inventory using Adjustments in Inventory. |

|

Ending Inventory Value |

|

|

Hot Shot Parts Sold |

Total cost of non-stock parts sold |

Category Sales

This section displays sales and profit margin information by labor category. For each labor category, the following information is provided:

| Column | Definition |

|---|---|

|

RO Count |

Total number of repair orders that included that category. |

|

% of ROs |

Percentage of repair orders closed that day that included that category. |

|

Part Net Sales |

Total part sales included in that category. |

|

Taxable Fees |

Total taxable parts fees included in that category. |

|

Parts Cost |

Total cost of parts included in that category. |

|

% Part Margin |

Percentage of total parts sales included in that category. |

|

Labor Sales |

Total labor sales included in that category. |

|

Sublet Sales |

Total sublet sales included in that category. |

|

Supply Sales |

Total supply charges calculated for that category. |

|

Sales |

Total sales included in that category. |

|

Sales Margin $ |

Total dollar amount of profit for that category. (Sales - Parts and Labor Costs) |

|

Sales Margin % |

Percentage of profit for that category. |

|

Discounts |

Total discounts calculated for that category. |

|

Coupons |

Total coupons used for that category (Coupons are available only for R.O. Writer Express users). |

|

% of Gross Sales |

Percent of Gross Sales that were discounts and coupons. |

Fleet Sales

This section shows your fleet sales.

| Column | Definition |

|---|---|

|

Total ROs |

Total number of repair orders closed. |

|

Fleet ROs |

Total number of fleet repair orders closed. |

|

Total Sales w/Tax |

Total sales including sales taxes not including fleet sales. |

|

Fleet Sales w/Tax |

Total fleet sales including sales taxes. |

|

Total amount of off invoice fleet discounts. |

|

|

Net Sales w/Tax |

Total Sales both regular sales and fleet sales. |

Employee Hours

This section displays all employees, their total hours for the day and whether they are clocked in or clocked out using the Employee Time Clock.

Labor Information

This section displays detailed information about Technicians. Each row is a technician.

| Column | Definition |

|---|---|

|

Technician |

Technician's name |

|

Jobs |

Total number of jobs performed by the technician |

|

Labor Sales |

Amount of labor sales |

|

Parts Sales |

Amount of part sales |

|

Other |

Non-taxable supplies, sublet, and supply charges |

Totals for Labor Information

| Column | Definition |

|---|---|

|

Job Average |

Average amount per job. |

|

Jobs Per Clock Hour |

Number of jobs performed per hour clocked in. |

|

$ Per Clock Hour |

Amount of Sales generated per hour clocked in. |

|

Amount billed to customer on labor jobs. |

|

|

The Elapsed Time which is calculated when using the Labor Time Clock. |

|

|

Clock Time |

Total hours clocked in using the Employee Time Clock. |

|

Productivity |

The percentage of how many hours the technician was available; measured by the amount of time clocked in during the date range specified using the Employee Time Clock compared to the hours billed. |

|

Efficiency |

The percentage of hours billed compared to actual time. |

|

The percentage of hours the technician spent working on repairs (based on the Elapsed Time recorded by the Labor Time Clock) compared to the number of hours he or she was clocked in (using the Employee Time Clock). The calculation is Actual Time / Clock Time *100. |